Supreme Court Cases That Could Affect Our Lives

March 11, 2023

9 people have the power to affect American lives for better or for worse. They are the justices on the US Supreme Court who recently heard crucial cases for everyday life. Currently, the Supreme Court has a conservative majority of 6 Republicans and 3 Democrats.

Student Loan Forgiveness

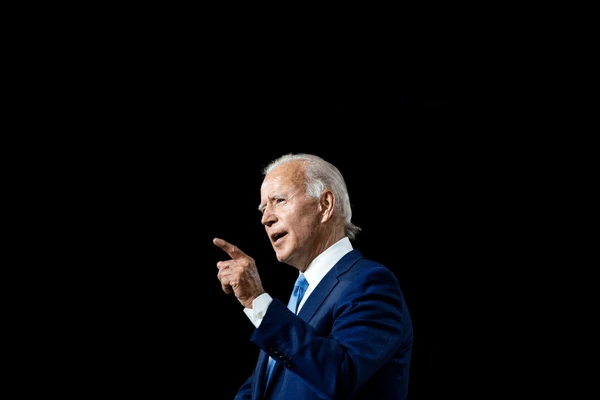

The Supreme Court heard cases regarding a student debt relief plan in cases Biden v. Nebraska and Department of Education v. Brown. Main questions for them are whether States can challenge the student-debt relief plan or if the plan exceeds executive authority.

President Biden announced a plan to forgive up to $20,000 for borrowers with limited earnings. He hoped students could “crawl out from under that mountain of debt.” This would affect 45 million Americans, who collectively have 1.75 trillion dollars in student loan debt. Biden invoked a law that states in times of national emergency, the secretary of education can “waive or modify any statutory or regulatory provision” in order to protect borrowers. In this instance, it was the pandemic. If this plan were enacted, it is estimated it would cost the US $400 billion dollars over the next 30 years.

Republican Chief Justice Roberts said “we’re talking about half a trillion dollars and 43 million Americans. How does that fit under the normal understanding of modifying?” He and other justices said the program that costs a lot of money and affects many people should have been approved by Congress. Roberts added “We take very seriously the idea of the separation of powers and that power should be divided to prevent its abuse.¨

Democrat Sonia Sotomayor thought about those in debt saying “they don’t have friends or families or others who can help them make these payments.” They wouldn’t be able to pay off their loans and so they would be in a worse financial situation. She added when “you can’t get credit, you’re going to pay higher prices for things. They are going to continue to suffer from this pandemic in a way that the general population doesn’t.”

A way to save the plan is from some arguing that the states that sued the Biden Administration weren’t actually injured by the debt cancellation, so they shouldn’t be able to sue in the first place. It is more likely that the Biden program will likely be struck down for exceeding executive authority. “I’m confident we’re on the right side of the law,” Biden told reporters, “But I’m not confident about the outcome of the decision yet.”

Decisions of the cases are expected in early summer 2023.

The Internet

The Supreme Court has the power to alter the internet as we know it.

Arguments have been heard from the two cases Gonzalez v. Google LLC and Twitter, Inc. v. Taamneh. The main question is if Section 230 immunizes websites in targeted recommendations of information from a third party content provider.

Section 230 of the 1996 Communications Decency Act is a law that protects internet platforms from liability for having third party content on their sites. Both lawsuits were brought up because family members had died in terrorist attacks. One familiy sued Google for failing to remove terrorists videos and recommending them to other people. They argued recommending terrorist videos to those interested promotes terrorist attacks for the future. Google and other companies argue that going against Section 230 goes against many years of legal precedent.

“You know, these are not like the nine greatest experts on the internet” Justice Elena Kagan remarked.

Justice Brett Kavanaugh said if there is a ruling against Google the “lawsuits will be nonstop.” He also added this “would really crash the digital economy with all sorts of effects on workers and consumers, retirement plans and what have you.”

The lawyer for the families is Eric Schnapper, who argued social media companies should be responsible for its algorithm. Ruling against Google could require removal of problematic content. Internet platforms might have to alter their algorithms, though it would be a while until that is apparent.

Verdicts are likely to be announced in early summer 2023.

Consumer Protection

Another case is the Consumer Financial Protection Bureau v. Community Financial Services Association of America.

The Consumer Financial Protection Bureau was created after the 2008 national financial crisis to ensure that markets for consumer financial products are fair, transparent, and competitive. Its purpose is to protect people from predatory practices in mortgages, credit cards and consumer loans.

Lower courts have declared the CFPB to be unconstitutional because it is directly funded by the Federal Reserve. It is argued that money to the Bureau needs to be appropriated annually by Congress. The Appropriations Clause of the Constitution says “no money shall be drawn from the Treasury, but in consequence of appropriations made by law.”

Other agencies such as the Federal Reserve, US Postal Service, and US Mint aren’t funded by appropriations from Congress. Senior policy and litigation counsel at the nonpartisan research group Center for Responsible Lending Nadine Chabrier said this decision “would set a dangerous precedent that would be used to challenge agencies with legally indistinguishable funding, including the Federal Reserve, F.D.I.C., Medicare and Social Security.”

The Supreme court will hear arguments in the next term, so a decision should be expected in 2024.

Anne Leet-Curran • Mar 19, 2023 at 11:05 am

Great work, Tane!!